ADaPTing Ugandan coffee supply chains

ADaPTing Ugandan coffee supply chains - Digital procurement and payment systems to achieve inclusive and scalable agro-food value chains.

Evidence suggests that value chain upgrading is often strongly associated with elite capture, fail to provide any value for participants, or are unable to scale. We have characterised these as the Crowdy Three, with transaction costs between producers and downstream firms a core driver as to why value chain upgrading is rarely inclusive.

Cash-based procurement programs within agro-food supply chains remain ubiquitous yet the need for cash to facilitate effective purchasing is a hard constraint that generates large transaction costs, difficult governance issues and is inherently unsafe. Intersection Traders Pty. Ltd and Heuris Pty Ltd have successfully trialledmobile money procurement processes to reduce transaction costs in procurement processes in the Smallholder Inclusive Value Chain in Mt Elgon, Uganda.

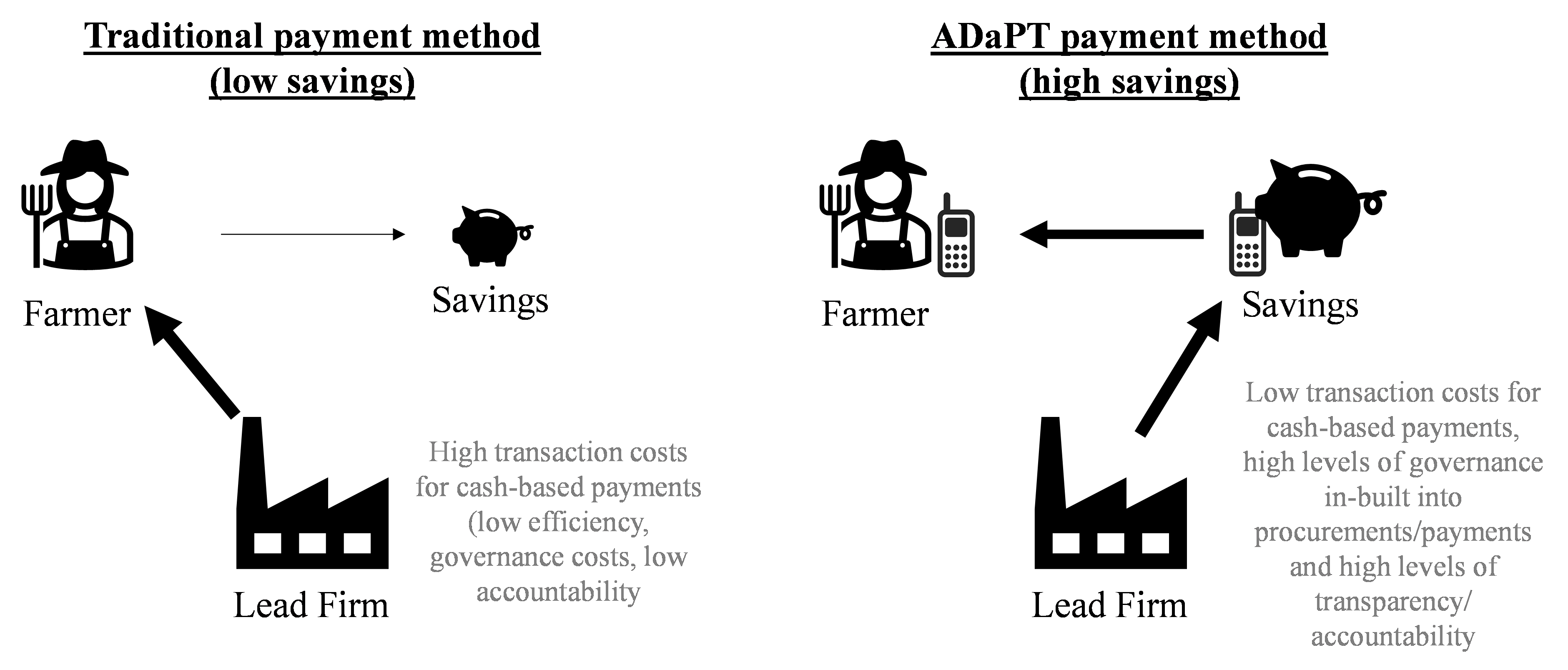

The intervention to be undertaken in this project is conceptually straight-forward: change the method of payment from economic activities from a cash-based payment to a digital payment.

This program and tool we are developing to streamline procurement and quality assurance the 'Automatic Disbursements and Procurement Tool' (ADaPT). A core aim of the ADaPT program is to provide participants with digital savings and investment tools to overcome intra-personal and social factors that result in sub-optimal savings and consumption. In other words, ADaPT has the potential to improve welfare outcomes for smallholder, coffee growing households in our value chain.

Find out more about the theoretical concepts of Crowdy Three. If you would like to know more about the ADaPT tool, or would like to get involved, feel free to get in touch.

How digital payment has reduced transaction costs in procurement and quality assurance

How we have resolved quality assurance through the Smallholder Inclusive Value Chain. At Heuris we are working towards more inclusive and scalable value chains by reducing transaction costs in engaging with smaller growers. Central to this is the Smallholder Inclusive Value Chain (SIVC) which has been operating since 2018 in in the coffee growing regions of Mt Elgon, Uganda. The program involves a novel governance and procurement regime that has been proven to generate substantial value improvements for export coffee and that achieves very high levels of inclusivity.

SIVC is operated by an Australian-based ethical coffee start-up Intersection Traders Pty. Ltd and is supported by Heuris. Core to the SIVC are efficient quality assurance processes that minimise transaction costs in procuring high quality coffee. These processes have been shown to be highly accessible and inclusive for smallholder farms, with a very high number of contributing farmers per tonne of equivalent green coffee (~30 farmers per tonne) compared to any high-value program currently in operation. Over half of the volume of accepted coffee provided by youth and 40% by volume by women, and the program provides an increase in value to farmers of, on average, 20%-40% compared to normal market prices. More detail of the quality assessment and incentives program of SIVC can be found here.

How cash payment systems represent an ongoing constraint for inclusion and scalability

Whilst efficient quality assurance addresses the main transaction cost concerns for inclusive value chain upgrading, it is not the only source of transaction costs in value chain upgrading. Cash-based procurement programs within core agro-food supply chains remain ubiquitous yet the need for cash to facilitate effective purchasing is a hard constraint that generates large transaction costs, difficult governance issues and is inherently unsafe. For example in the SIVC, the daily cash holdings needed for each agent buying coffee are worth in excess of 1.5 months of labour in an area in which there is little full-time employment available. Obtaining this volume of cash is difficult (bank lines are long and often there is not the amount of cash actually available), dangerous, and creates major governance (fraud, corruption) issues that are difficult to monitor and manage. These constraints to scale with the number of producers engaged, creating incentives to only engage with larger farmers. Resolving these cash-based transaction costs from procurement processes can help achieve more inclusive outcomes for the value chain.

Given the unavoidable issues associated with a cash-based transfers program in the Smallholder Inclusive Value Chain, Intersection Traders Pty. Ltd and Heuris Pty Ltd have successfully trialled mobile money procurement processes to reduce transaction costs in procurement processes.

The growth and benefits of mobile money in rural communities

Mobile money enables mobile phone owners to deposit, transfer, and withdraw funds using sim cards and airtime credit, without owning a bank account.Mobile money has significant penetration in East Africa. For example, Uganda has over 27 million registered mobile money accounts within a population of 45 million, enabling access to financial services that were previously out of reach for many due to high costs and limited access to more traditional financial services. Importantly, mobile money has provided more affordable access to financial services for women, youth and landless poor who increasingly have access to cheaper and reliable mobile phones and services (e.g. Suri and Jack 2016).

Mobile money is not mobile banking, it is a service provided by telecommunications companies and sits outside the formal banking system. It operates through a menu on their SIM card and allows consumers to engage in a variety of financial transactions, including person to person payments, pay bills, store and hold money, and receive payments and wages from businesses. Cash is deposited or withdrawn from distributed mobile money agents who are typically local businesses or individuals, meaning that agents are more distributed and more accessible than formal financial services.

The impact of mobile money has been well documented in the literature. Users of mobile money have been shown to be more resilient to shocks through better access to social networks and remittances and have improved savings and consumption patterns within the households (Suri 2017). The privacy of mobile money can enable allow for private transfers and transactions, providing for individuals within households to have financial independence. This feature is particularly important for women in the presence of unequal intra-household bargaining power.

How we are resolving cash-based constraints in the Smallholder Inclusive Value Chain.

Heuris is investigating further ways in which we can make the procurement and quality assessment process more efficient and accessible for smaller farmers, women and youth.

The intervention to be undertaken in this project is conceptually straight-forward: change the method of payment from economic activities from a cash-based payment to a digital payment. This is outlined in the figure below.

Intersection Traders and Heuris have trialled the potential approach to making payments to smallholders supplying coffee to processors/buying agents within the coffee growing region in Mt Elgon. This program and tool we have called the ‘Automatic Disbursements and Procurement Tool’ (ADaPT).

Individuals who provide coffee to Intersection Traders have a choice – either receive payment through cash or through mobile money. Slightly higher premiums (~ 500 UGX per KG) are offered for mobile money payments given the lower transaction costs for Intersection Traders in managing payments via mobile money compared to cash. Nearly all participants opted into receiving payments via mobile money, indicating a strong preference for using mobile money

Whilst the practicalities of this approach are more complicated the methods outlined here, ADaPT seeks to integrate procurement and quality assurance program within one tool to further find efficiencies in procurement and provide greater traceability and governance within the supply chain. We are currently developing ADaPT to trial in the supply chain in upcoming harvest season.

If you would like to know more about ADaPT or would like to get involved, please get in touch.

How digital payments such as mobile money can provide complementary welfare outcomes for participants.

Another core factor leading to failure in achievement of development outcomes associated with value chain interventions is a growing realisation that income receipts are subject to ‘taxes’ that erode the relationship between income improvement and saving. These ‘taxes’ are associated both with intra-personal factors (e.g. heuristic approaches to consumption and behavioural anchoring such as ‘keeping up with the Joneses’) and with social factors (e.g. spousal claims over income, extra-kinship claims, social obligations and income sharing). As a result of these psycho-social taxes, chronic poverty remains a major concern in rural areas of developing countries.

Shifting smallholder-dominated supply chains from cash-based procurement approaches to digital payments approaches has the potential to provide for a substantial development program focused on improving access to, and engagement with, digital savings and investment tools.

A core aim of the ADaPT program is to provide participants with digital savings and investment tools to overcome intra-personal and social factors that result in sub-optimal savings and consumption. Below we outline a number our hypotheses in how shifting to digital payments can improve the welfare for participants.

Hypothesis 1: Payments directly into a digital banking program generate substantial decreases in hedonic consumption and intra-household/social transfers of income compared to cash payments

Somville and Vandewalle (2018) show that changing the form of money that income is received in from cash to electronic (i.e. located within a bank account) increases short-term savings by over 130% in a rural Indian setting. Similar findings are also reported in Mozambique (Batista and Vicente 2020) and Niger (Aker et al 2016). We hypothesise that similar effects will be seen for supply chain payments made using cellular banking programs: specifically that individuals receiving income as a transfer to their cellular banking account will have substantially higher savings rates and lower rates of hedonic consumption/transfers to other household members (e.g. spouse).

Hypothesis 2: Digital transfer methods disproportionately help women and youth to save income compared to men and promotes greater targeting of expenditures on household (public) goods

A growing area of research is in financial linkages to the empowerment of women in the household (e.g. Almas et al. 2018; Castilla 2019). Based on this literature we hypothesise that women and youth are better able to maintain independent control of income when it is received as a transfer to cellular banking accounts compared to when it is received as cash. Support for this hypothesis would provide for a clear mechanism to improve women and youth empowerment within households in rural areas of developing countries.

Hypothesis 3: Behavioural ‘nudge’ type interventions can be effectively used within a digital payments platform to generate long-lasting increases in rates of saving from supply chain payments or other transfers

Garbinsky et al. (2021) show that very simple behavioural interventions can increase short-term savings rates by up to 30% for rural smallholder households. We hypothesise that these types of interventions are even more effective in the setting of income received through cellular banking initiatives: i.e. specifically that the impact in terms of level and period of increased saving behaviour is increased when ‘nudge’ type interventions are applied in combination with cellular banking income transfer methods.

Hypothesis 4: A financial education extension program magnifies the effect of savings increases from participation in the digital payments program

It is increasingly thought that ‘graduation’ from poverty relies on a package of interventions, including educational/extension components (Banerjee et al. 2016). Financial knowledge may be a core component in facilitating individuals to engage with concepts of saving, investment and consumption planning. We hypothesise that financial education alone does little to change savings/consumption behaviours of households but that combined with a cellular banking initiative that offers a savings program (i.e. deferred income receipts) savings effects are greater than either the extension or savings programs offered alone.

Hypothesis 5: The majority of households prefer to receive supply chain payments in digital form rather than in cash, and a higher preference for digital payment is positively associated with decreasing household cohesion (norms, empowerment), increasing kinship claims, and greater propensity to a lack of short-term self-control

A critical element of digital payment platforms having ‘natural’ intervention characteristics is that they are preferred as payment mechanisms by the majority of smallholder supply chain participants. Early data (from the 2020 coffee buying season) based on tests our team conducted regarding usage of digital payments within project partners’ supply chains indicated an almost complete preference for digital payments by over 150 smallholder supply chain participants (out of ~170 total smallholders within the initial test). We hypothesise that these patterns are likely to continue amongst the wider population and to be associated with psycho-social ‘taxes’ that smallholder households might seek to moderate.

Figure 3: Cash payments in the Smallholder Inclusive Value Chain are beign replaced by mobile money (image courtesy of Intersection Traders)

References

Aker, J.C., Boumnijel, R., McClelland, A. and Tierney, N., 2016. Payment mechanisms and antipoverty programs: Evidence from a mobile money cash transfer experiment in Niger. Economic Development and Cultural Change, 65(1), pp.1-37.

Almas, I., Armand, A., Attanasio, O. and Carneiro, P., 2018. Measuring and changing control: Women’s empowerment and targeted transfers. The Economic Journal, 128(612), pp.F609-F639.

Banerjee, A., Duflo, E., Goldberg, N., Karlan, D., Osei, R., Parienté, W., Shapiro, J., Thuysbaert, B. and Udry, C., 2015. A multifaceted program causes lasting progress for the very poor: Evidence from six countries. Science, 348(6236), p.1260799.

Batista, C. and Vicente, P.C., 2020. Improving access to savings through mobile money: Experimental evidence from African smallholder farmers. World Development, 129, p.104905.

Bellemare, M. F. & Bloem, J. R. 2018. Does contract farming improve welfare? A review. World Development, 112, 259-271.

Castilla, C., 2019. What's yours is mine, and what's mine is mine: Field experiment on income concealing between spouses in India. Journal of Development Economics, 137, pp.125-140.

Garbinsky, E.N., Mead, N.L. and Gregg, D., 2021. Popping the Positive Illusion of Financial Responsibility Can Increase Personal Savings: Applications in Emerging and Western Markets. Journal of Marketing, 85(3), pp.97-112.

Somville, V. and Vandewalle, L., 2018. Saving by default: Evidence from a field experiment in rural India. American Economic Journal: Applied Economics, 10(3), pp.39-66.

Suri, T. and Jack, W., 2016. The long-run poverty and gender impacts of mobile money. Science, 354(6317), pp.1288-1292.

Suri, T., 2017. Mobile money. Annual Review of Economics, 9, pp.497-520.

Ton, G., Vellema, W., Desiere, S., Weituschat, S. & D'haese, M. 2018. Contract farming for improving smallholder incomes: What can we learn from effectiveness studies? World Development, 104, 46-64.

Vicol, M., Neilson, J., Hartatri, D. F. S. & Cooper, P. 2018. Upgrading for whom? Relationship coffee, value chain interventions and rural development in Indonesia. World Development, 110, 26-37.